Table Of Content

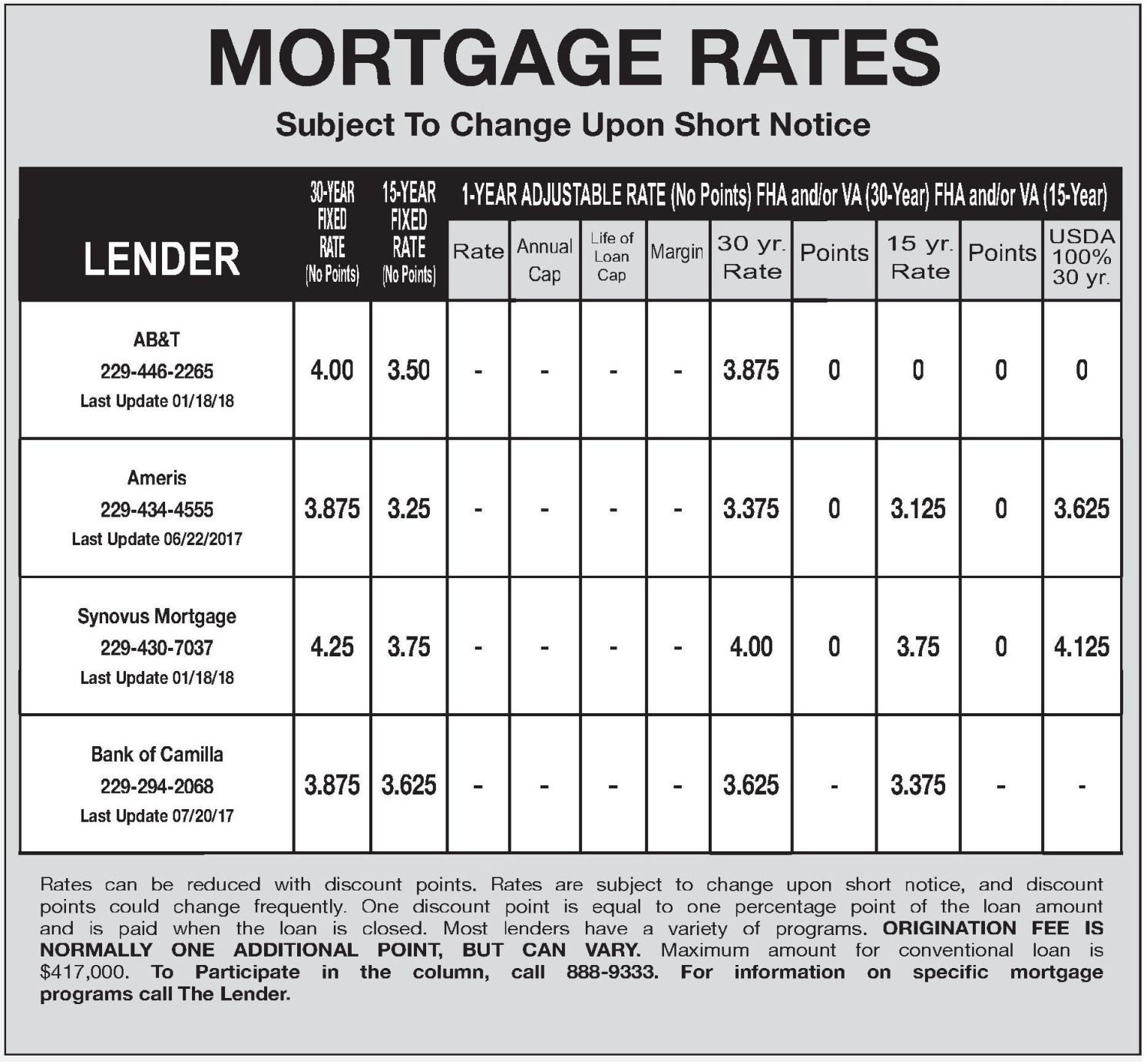

Mortgage rates drop or rise daily, reacting to changing economic conditions, central bank policy decisions, and investor sentiment. The table shows current mortgage interest rates and APRs by loan term. Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio. Gross monthly income is the total amount of money you earn in a month before taxes or deductions.

Mortgage Calculator

Our research is designed to provide you with a comprehensive understanding of personal finance services and products that best suit your needs. To help you in the decision-making process, our expert contributors compare common preferences and potential pain points, such as affordability, accessibility, and credibility. First, you’ll need to do the hard work of saving up $80,000 in cash as a 20% down payment. Or if you already own a home, make sure you have enough equity to pay off your current mortgage and cover your down payment when you sell it.

Best Home Improvements to Increase Value - Zillow Research

Best Home Improvements to Increase Value.

Posted: Fri, 11 Aug 2023 07:00:00 GMT [source]

What factors help determine 'how much house can I afford?'

Now, your mortgage lender will probably approve you for a bigger mortgage than you can afford. That’s why you should save up an emergency fund worth 3–6 months of your typical expenses before you buy a house (in addition to paying off all your consumer debt). When you don’t have an emergency fund, any unexpected expense that pops up can become a crisis. But with an emergency fund, an unexpected expense becomes nothing more than an inconvenience. Our home affordability calculator can help you figure out how much you should spend on a house.

Zillow: Student loan borrowers had 3.5 years without payments, yet many still can't afford to break into the housing market - Fortune

Zillow: Student loan borrowers had 3.5 years without payments, yet many still can't afford to break into the housing market.

Posted: Wed, 26 Jul 2023 07:00:00 GMT [source]

Understanding the 28/36 rule for home affordability

You never know when a global pandemic might wreak havoc on your ability to earn a living and pay for your home. Department of Veterans Affairs (VA) to provide eligible homeowners and buyers the help needed to buy, build, repair or refinance a home as long as it's a primary residence. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

How to get pre-qualified for a home loan

A lender is a financial institution that provides a loan directly to you. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

You’ll also need to factor in how mortgage insurance premiums — required on all FHA loans — will impact your payments. Your estimated annual property tax is based on the home purchase price. The total is divided by 12 months and applied to each monthly mortgage payment. If you know the specific amount of taxes, add as an annual total.

How Much House Can I Afford With a Conventional Loan?

It does not include title charges, recording costs, prepaids, initial escrow deposit, and other fees. You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you don’t wish to use NerdWallet’s estimates. Edit these figures by clicking on the amount currently displayed. For decades, Dave Ramsey has told radio listeners that the best way to buy a house is paying for it in cash.

It is calculated as a percentage of your total loan amount, and usually ranges between 0.58% and 1.86%. The annual property tax is an estimation based on the home's purchase price. The total is divided by 12 and applied to each monthly mortgage payment. If you know the specific amount of taxes, you can add it as an annual total or percentage. Use our VA home loan calculator to estimate your monthly mortgage payment with taxes and insurance. Simply enter the purchase price of the home, your down payment and details about the loan to calculate your VA loan payment breakdown, schedule and more.

What is mortgage pre-qualification?

Many lenders use this ratio to determine if you can afford a conventional home loan without putting a strain on your finances or causing you to go into default. The 28/36 rule also protects borrowers as much as it protects lenders, as you’re less likely to lose your home to foreclosure by overspending on a home. The funding fee rate for VA-backed refinanced loans doesn't change based on your down payment amount. If you purchase a manufactured home, you also only need to pay the first-time use funding fee rate. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

On mobile devices, tap "Refine Results" to find the field to enter the rate and use the plus and minus signs to select the "Loan term." It’s important to do your own analysis of your short, medium and long-term finances to see how much you can comfortably borrow. Budget 1% to 4% of your home’s value each year for home maintenance. You might not spend this amount each year, but you’ll spend it eventually. Find a lender on Zillow and discuss your VA loan eligibility with a lender who understands the VA loan process.

The Veterans Affairs Department (VA) is an agency of the U.S. government. VA loans make home ownership more possible for borrowers than it otherwise would be through conventional mortgage loans, primarily because a VA loan does not require any down payment. Additionally, interest rates offered for VA loans often turn out to be lower than those offered for conventional loans. The price is the amount you paid for a home or plan to pay for a future home purchase. Buying a home with a lower purchase price can help lower the monthly mortgage payment. Enter your home price into the VA loan payment calculator above.

A down payment isn’t the only cash you’ll need to save up to buy a home. Generally, the higher the credit score you have, the lower the interest rate you’ll qualify for and improve overall what you can afford in a home. Even lowering your interest rate by half a percent can save you thousands of dollars and increase your affordability range significantly. If you can put more money down, it lowers the risk for the lender which can positively impact your mortgage rate.

No comments:

Post a Comment